Dunning Management: Recovering Failed Payments Effectively

In the subscription-based economy, maintaining a steady cash flow is vital. Yet, failed payments and involuntary churn pose significant challenges, often costing businesses more than they realize. Dunning management: is a strategic process designed to address failed payments and recover revenue that might otherwise be lost. In this blog, we’ll explore dunning management in detail, its importance for businesses, and how solutions like Encomm’s failed payment recovery can streamline the process for optimal results.

What is Dunning?

Dunning is the systematic process of communicating with customers to recover failed or overdue payments. It often involves reminders through emails, SMS, Phone calls, and other channels, guiding customers to resolve payment issues. In the context of subscription-based businesses, dunning ensures the continuity of services while minimizing customer churn due to failed payments.

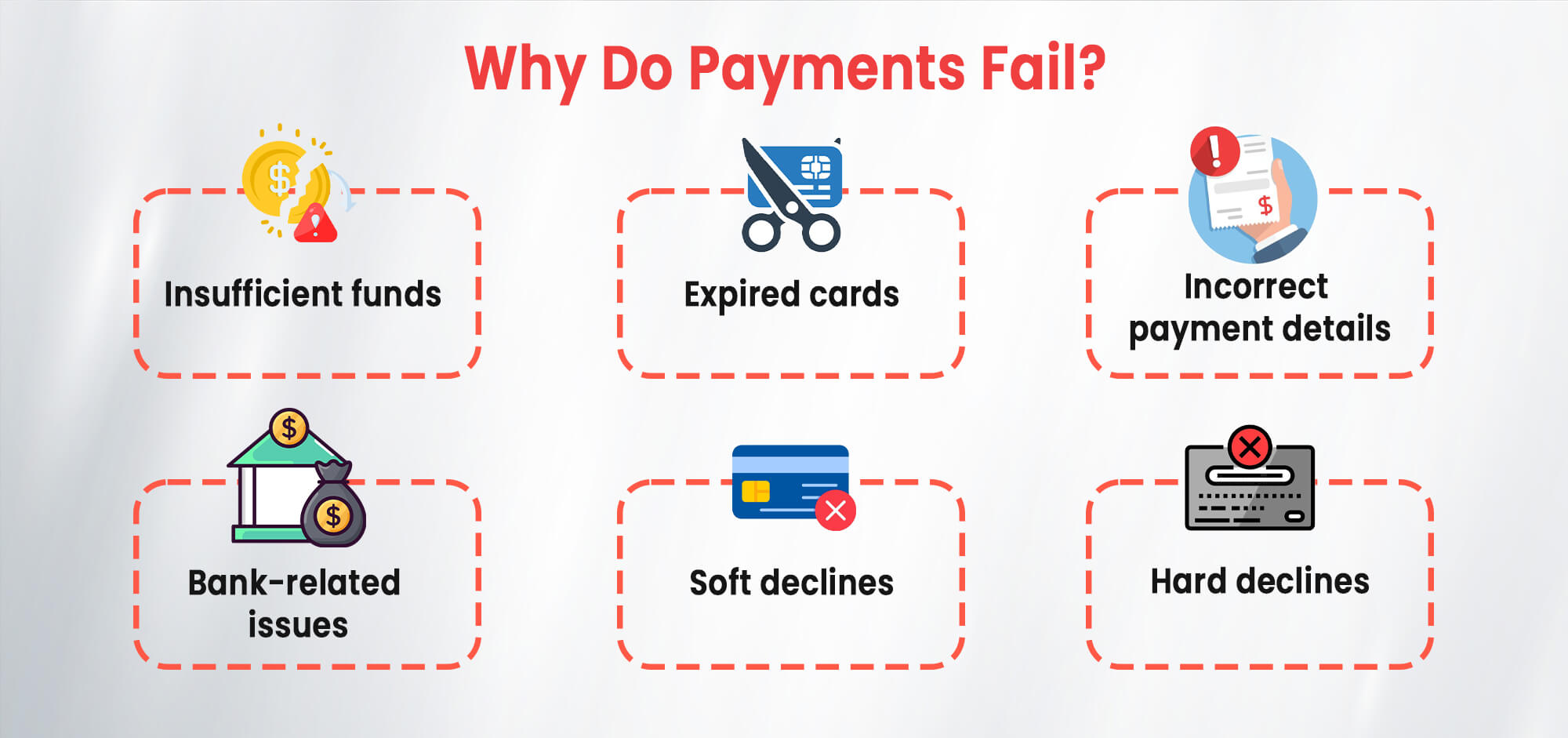

Why Do Payments Fail?

Failed payments can arise from a variety of factors, each impacting businesses differently. By understanding these reasons, companies can tailor their dunning strategies to address the root causes effectively. Here are some of the common reasons for payment failures:

- Insufficient funds: Customers may lack the necessary balance in their accounts.

- Expired cards: Payment methods on file may no longer be valid.

- Incorrect payment details: Errors in card or bank account information.

- Bank-related issues: Declines due to network problems, fraud detection measures, or international payment restrictions.

- Soft declines: Temporary errors, such as exceeding daily transaction limits.

- Hard declines: Permanent issues like a closed account or invalid card.

Knowing why payments fail allows businesses to implement tailored strategies for recovery. For instance, retrying payments for soft declines can work, but resolving hard declines may require proactive customer outreach. By addressing each failure type appropriately, businesses can recover more revenue, reduce churn, and maintain positive customer relationships.

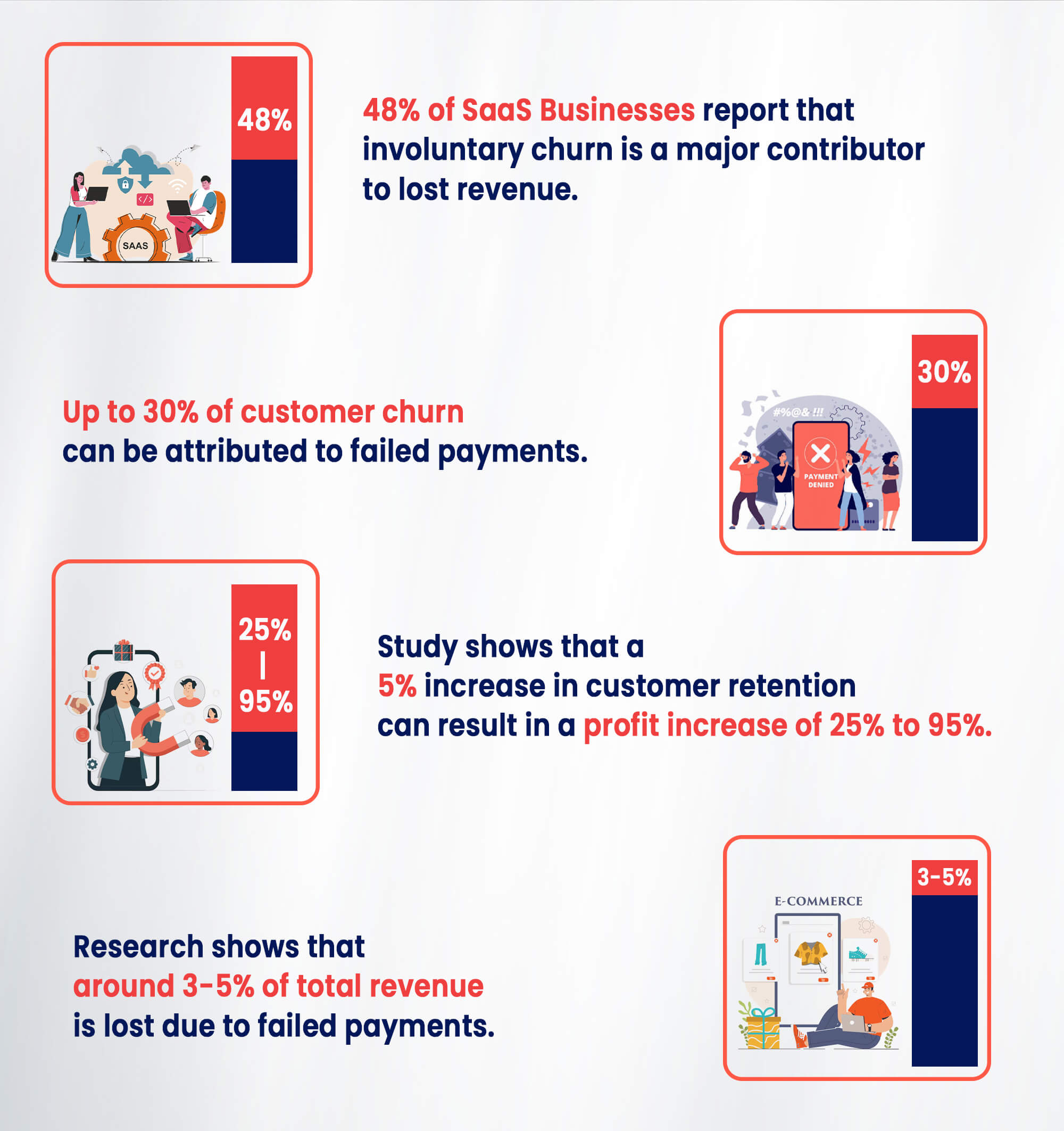

The Impact of Failed Payments on Revenue

Failed payments can cause significant financial strain for businesses, particularly those that depend on recurring revenue models, like SaaS or subscription-based companies. Involuntary churn, which is when customers unintentionally cancel or stop their subscriptions due to payment issues, is one of the biggest challenges these businesses face. Here are some key statistics that highlight the magnitude of the problem:

- 48% of SaaS Businesses report that involuntary churn is a major contributor to lost revenue. This shows just how widespread the issue is and how crucial it is to tackle payment failures effectively.

- Up to 30% of customer churn can be attributed to failed payments. This means nearly a third of customers may be leaving without ever intending to, simply because their payments didn’t go through.

- A Harvard Business Review study found that a 5% increase in customer retention can result in a profit increase of 25% to 95%. Retaining customers is clearly a powerful way to boost long-term profitability.

- For eCommerce businesses, research shows that around 3-5% of total revenue is lost due to failed payments. This is especially concerning as eCommerce businesses rely on seamless, one-click transactions, and any disruption can lead to abandoned carts or lost customers.

For subscription-based businesses, these statistics are alarming and highlight the need for effective dunning management to recover lost revenue, minimize churn, and ultimately improve profitability. Failed payments not only reduce immediate cash flow but also damage the overall customer experience, making it harder to retain clients over time.

Why Is Dunning Management Important for Subscription Businesses?

For businesses relying on recurring payments, the inability to recover failed payments has direct consequences on revenue and customer retention. When a payment fails, it may be seen by the customer as an inconvenience or a sign that the service is unreliable. If the issue is not resolved quickly, it can lead to customer frustration and even abandonment of the service.

In addition to the financial implications, poor management of failed payments can damage relationships with customers, leading to long-term churn. When customers experience difficulties or lack communication about their payment issues, they are more likely to churn—even if the problem could have been easily addressed with proper intervention.

Effective dunning management can significantly mitigate these issues and help businesses thrive. Here’s how:

- Recover Revenue: By quickly addressing failed payments through automated retries, timely reminders, and proactive communication, businesses can recover lost revenue. This minimizes the financial impact of failed transactions and helps maintain a steady cash flow.

- Enhance Customer Experience: Customers want convenience and transparency when it comes to their payments. Effective dunning management ensures that payment failures are handled smoothly and without causing unnecessary disruptions to the service. It also provides customers with multiple ways to update payment details, ensuring they remain satisfied with their experience and are less likely to churn.

- Improve Retention: By resolving payment issues promptly and efficiently, businesses can retain customers who might otherwise leave due to unresolved payment failures. Clear communication, such as sending reminders and offering easy ways to update payment methods, helps prevent customers from abandoning their subscriptions, leading to higher retention rates.

Dunning management is essential for any subscription-based business. It not only ensures that payments are recovered but also strengthens customer relationships and boosts overall retention. When done effectively, it can turn potential losses into opportunities for growth.

Best Practices for Effective Dunning Management

A well-thought-out dunning strategy involves a mix of automation, personalized outreach, and user-friendly processes. Here are some best practices:

1. Smart Retry Mechanisms

Implement retries based on error codes and customer payment behavior. For example, retrying after soft declines during optimal transaction windows increases success rates.

2. Automated Email and SMS Workflows

Set up automated workflows to notify customers of payment failures. Use reminders with clear instructions and links to update payment details.

3. In-App Notifications

For app-based businesses, in-app notifications can immediately alert users to resolve payment issues without relying solely on emails or SMS.

4. Remove Blockers

Make it easy for customers to update billing information. Offer secure, one-click solutions for payment updates.

5. Offer a Human Touch

When automation fails, personalized outreach through call center agents can bridge the gap. A friendly call can resolve issues that emails or SMS might not address.

6. Plan Effective Templates

Design payment failure notifications with clarity and empathy. Highlight the issue, urgency, and steps to resolve it.

7. Strategic Follow-Ups

Balance persistence with customer convenience. Send reminders at optimal intervals without overwhelming the customer.

How Can Encomm’s Dunning Management Help?

Encomm’s dunning management solution offers a holistic and efficient approach to recovering failed payments and minimizing revenue loss for businesses. By leveraging advanced technology, automation, and a personalized touch, Encomm helps companies retain customers and ensure smooth subscription cycles. Here’s a breakdown of how Encomm’s solution supports businesses in handling payment failures:

Smart Retries

The enComm Subscriptions app intelligently handles failed payments through smart retries, which is a key strategy for maximizing the chances of successful payment recovery. This feature automatically retries payments based on the error code received. For example:

- Soft declines (like temporary issues such as exceeding daily limits) can be retried after a short period.

- Hard declines (such as an expired card or closed account) are flagged for more immediate attention.

Encomm’s solution also optimizes the timing of retries, ensuring that payments are attempted at the most opportune moments, based on the specific error and customer behavior. Studies have shown that well-timed retries can significantly increase payment recovery rates.

Automated Workflows: Email and SMS Campaigns

Automated workflows are a key component of Encomm’s dunning management solution, and they play a critical role in notifying customers about failed payments and encouraging them to take immediate action. By using email and SMS campaigns, Encomm ensures that payment issues are addressed swiftly, minimizing the risk of involuntary churn and revenue loss.

Email Campaigns

Encomm’s automated email campaigns are designed to deliver timely and effective reminders to customers whose payments have failed. These emails are carefully crafted to:

- Alert customers instantly when their payment fails, providing clear instructions on how to update their payment information.

- Offer helpful next steps, guiding customers on how to resolve the issue—whether by updating their billing information, checking their bank account, or reaching out for further support.

- Be personalized based on customer history and transaction patterns, which increases engagement and response rates. Personalization can include addressing the customer by name, detailing the specific payment failure, and providing links directly to the customer’s account or payment page.

Research shows that well-timed email reminders can significantly increase recovery rates. According to a report from Chargebee, emails sent within the first 24 hours of a failed payment see an average response rate of 20%, with recovery rates improving by as much as 30% when emails are part of a structured follow-up sequence

SMS Campaigns

SMS notifications are a powerful tool for immediate, attention-grabbing communication. Encomm’s SMS campaigns complement the email reminders by:

- Sending concise, urgent alerts that capture the customer’s attention quickly. SMS messages have a higher open rate (98%) compared to emails, making them an effective way to prompt swift action

- Reinforcing the urgency of the issue. SMS messages typically have a more immediate tone, which encourages quicker responses and reduces the window of time before action is taken.

According to data from SMS marketing studies, 45% of consumers are more likely to act on an SMS notification than on an email, making it a critical part of a successful dunning strategy.

Encomm’s automated email and SMS campaigns help businesses recover failed payments by keeping customers informed, guiding them toward resolution, and ensuring that payment issues are addressed promptly. By delivering timely and personalized notifications via these highly effective channels, Encomm maximizes the chances of successful payment recovery and minimizes involuntary churn, ensuring that businesses can retain customers and recover lost revenue.

Proactive Outreach: Call Center-Based Recovery

While automated email and SMS workflows are crucial for addressing payment failures quickly, there are cases where customers may miss or ignore notifications. In these instances, proactive outreach through a human touch becomes an essential component of effective dunning management. Encomm leverages call center agents to follow up on unresolved payment issues, offering a personalized recovery experience that increases the chances of successfully recovering lost payments.

Human Touch via Phone Calls

A personal phone call from a call center agent can be far more impactful than automated messages, especially for customers who may be facing challenges with their payment methods. Here’s why a human approach works:

- Personalized Interaction: Call center agents can engage with customers in real-time, addressing specific issues related to their payment failure. For example, if a customer’s credit card has expired or their account has been flagged for fraud, the agent can help them resolve the problem immediately. This real-time problem-solving can significantly reduce friction and the chances of customers leaving due to unresolved payment issues.

- Building Trust: Receiving a call from a friendly, professional agent can build customer trust. It demonstrates that the business values the customer and is willing to go the extra mile to ensure their experience is positive. In fact, studies show that businesses that provide personalized service over phone calls experience up to 50% higher customer satisfaction compared to those relying solely on automated solutions.

Call center agents can explain any ambiguities in the payment process, offer solutions in a more detailed manner, and even guide customers through updating their billing information.

Research indicates that personal calls have a 25% higher conversion rate in payment recovery compared to automated channels.

Resolve Complex Issues: Some failed payments may involve more complex issues, such as cross-border payment issues or fraud detection holds. Call center agents can explain these situations to customers, helping to alleviate any confusion or frustration. This is especially important for businesses with international customer bases, where language barriers or technical issues may arise.

A Balanced Approach: Combining Automation and Human Outreach

While automated workflows through email and SMS are effective for prompt reminders, human outreach through phone calls ensures that businesses don’t lose customers due to impersonal communication. The combination of automation for initial alerts and human intervention for unresolved cases creates a balanced, effective dunning strategy.

This dual approach has been shown to reduce involuntary churn and improve payment recovery rates. Businesses that employ a mix of automated notifications and human touch typically experience a 30-40% increase in recovery compared to relying solely on automation.

Conclusion

Dunning management is not just about recovering failed payments—it’s about maintaining customer relationships and ensuring the sustainability of your revenue model. By adopting best practices and leveraging solutions like Encomm’s dunning management, businesses can turn payment failures into opportunities to enhance customer trust and loyalty.