Why Do Subscription Payments Fail: Top Reasons for Credit Card Declines and How to Fix Them

Subscription models are at the heart of many businesses today, offering convenience for customers and recurring revenue for companies. However, one major obstacle that businesses face is failed subscription payments. These failures can lead to churn, lost revenue, and frustrated customers. Understanding why payments fail and implementing effective recovery strategies is crucial to maintaining customer loyalty and protecting your bottom line.

This blog explores the difference between voluntary and involuntary churn, the reasons behind credit card payment failures, and actionable strategies to recover failed payments.

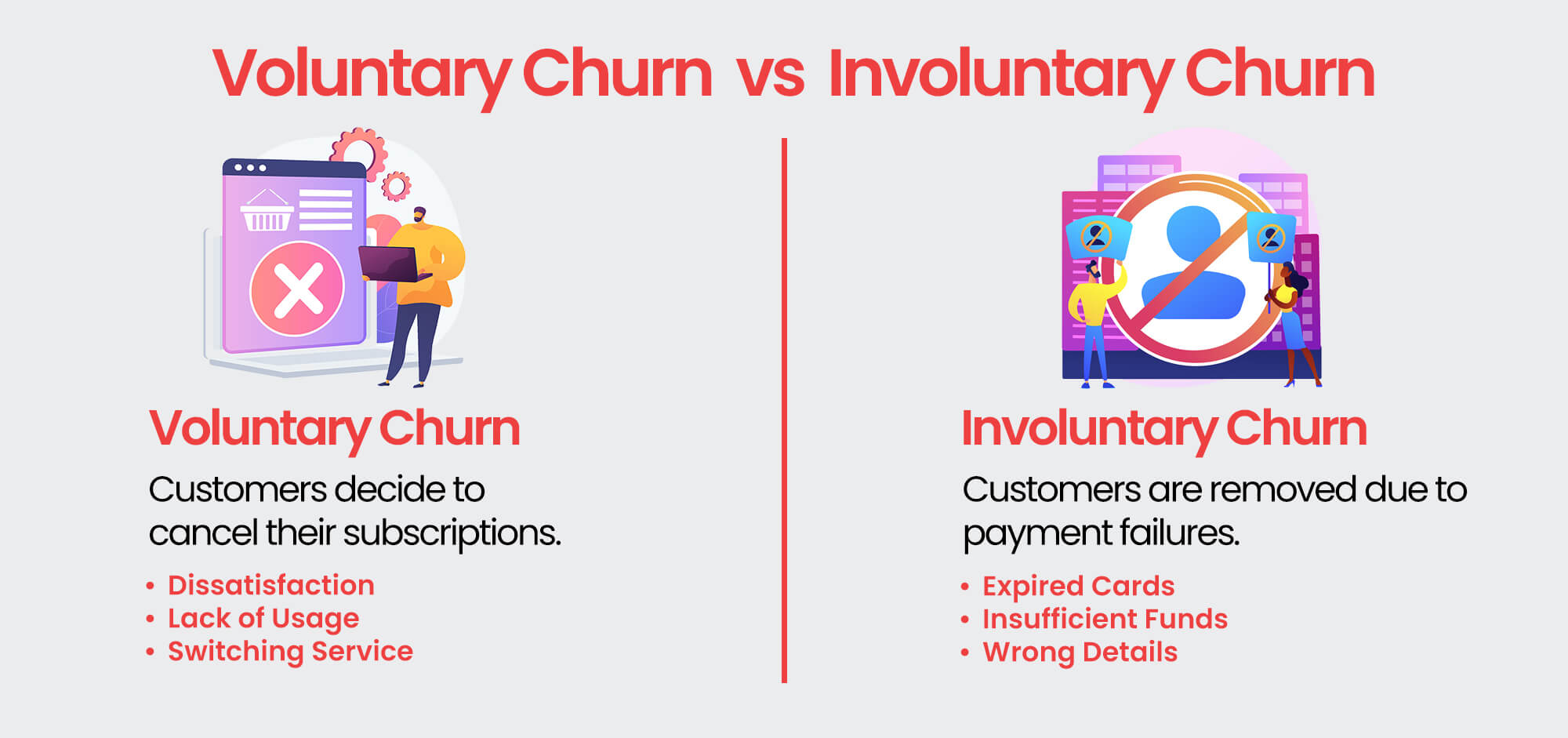

Voluntary vs. Involuntary Churn

Churn is a term used to describe customers discontinuing their subscription services. It can be divided into two categories:

- Voluntary Churn:

Voluntary churn occurs when customers actively decide to terminate their relationship with a company. This conscious decision can stem from various factors, including:

- Dissatisfaction with the Product or Service: Customers may feel that the offering doesn’t meet their expectations or lacks essential features.

- Poor Customer Experience: Negative interactions with support teams or unresolved issues can drive customers away.

- Better Competitor Offerings: Availability of superior or more cost-effective alternatives can entice customers to switch.

- Lack of Engagement: Customers who don’t perceive value or don’t regularly use the product may choose to cancel.

- Involuntary Churn:

Involuntary churn happens without the customer’s intentional decision to leave. It typically results from issues beyond the customer’s immediate control, such as:

- Payment Failures: Declined transactions due to expired credit cards, insufficient funds, or outdated payment information.

- Technical Issues: System errors that prevent successful renewals or access to services.

- Administrative Errors: Mistakes in account management leading to unintended cancellations.

Involuntary churn is particularly detrimental because it often involves customers who would have preferred to continue their subscriptions. Implementing effective dunning management strategies, maintaining accurate customer data, and ensuring seamless payment processes & recovery are crucial steps to mitigate involuntary churn.

Involuntary churn accounts for up to 30% of customer losses in subscription-based businesses, making it a critical issue to address.

Types of Credit Card Payment Failures

Credit card payment failures can be broadly categorized into two types: soft declines and hard declines.

Soft Declines occur due to temporary issues that can often be resolved with retries. These failures typically arise from situations like exceeding daily transaction limits, network connectivity issues, or insufficient funds in the account at the time of processing. Since soft declines are not permanent, a well-timed retry strategy can often lead to a successful transaction without requiring any intervention from the customer. Businesses that implement smart retry mechanisms based on error codes or transaction patterns can recover a significant portion of failed payments caused by soft declines.

Hard Declines, on the other hand, stem from permanent issues that cannot be resolved by simply retrying the payment. These include problems like closed or inactive accounts, invalid card details, or cardholder disputes. In such cases, the customer’s direct action is required to update their payment information or resolve the underlying issue. For businesses, addressing hard declines involves proactive communication, such as notifying customers via email, SMS, or in-app reminders, and making it easy for them to update their billing details promptly.

Understanding whether a failure is a soft decline or a hard decline is critical, as it allows businesses to adopt the right approach to resolving payment issues and minimizing revenue loss.

Top Reasons for Credit Card Declines or Payment Failures

Credit card declines or payment failures can be frustrating for both businesses and customers. Understanding the root causes can help businesses implement effective strategies to prevent or recover failed payments. Here’s a detailed look at the most common reasons for payment failures, along with real-world examples:

Insufficient Funds

One of the most common reasons for payment failure is insufficient funds in the customer’s account. This occurs when the customer does not have enough balance to cover the transaction. For example, a customer subscribing to a streaming service at the end of the month may not realize that their account balance has dipped below the subscription fee due to other recurring payments or unexpected expenses. Businesses can mitigate this by offering grace periods or sending pre-billing notifications to remind customers to ensure sufficient funds in their accounts.

Expired Credit Cards

Credit cards have expiration dates, and transactions will fail if customers forget to update their payment details after their cards expire. For instance, a fitness app subscription may fail if the customer’s credit card expired last month, and they didn’t update their information on the app. Businesses can proactively address this issue by sending automated reminders to customers before their card expires and providing a seamless way to update payment details.

Incorrect Payment Information

Human errors like mistyping card numbers, entering the wrong CVV code, or selecting an incorrect expiration date often lead to failed transactions. For example, a customer setting up a new account on an e-commerce site may accidentally enter a wrong digit while inputting their card number, causing the payment to be declined. To reduce this, businesses can incorporate real-time validation checks during the payment process and guide customers to double-check their details.

Fraud Detection by Banks

Banks and payment processors often decline transactions flagged as potentially fraudulent. This can happen when the payment involves international transactions or sudden, unusual spending patterns. For instance, a customer traveling abroad may attempt to pay for a subscription, but the bank flags the transaction as suspicious because it’s outside their typical spending region. Businesses can reduce false declines by implementing tools that allow customers to verify flagged transactions quickly, such as SMS-based verification or in-app confirmations.

Transaction Limits

Credit cards often have daily or monthly transaction limits, and exceeding these limits results in payment failures. For example, a customer may max out their credit card while making large purchases during a sale and subsequently fail to pay for their monthly subscription. Businesses can preemptively notify customers when an upcoming payment is due or provide options to split large payments into smaller, more manageable amounts.

Technical Errors

Technical glitches between payment processors, banks, or even the merchant’s platform can disrupt transactions. For example, network outages during a busy holiday shopping season may prevent a customer’s credit card transaction from going through. Businesses can address this by implementing smart retry mechanisms to automatically attempt the transaction again after a delay, ensuring successful payment without customer intervention.

Blocked Cards

Banks may block a card due to repeated incorrect PIN attempts, suspected fraudulent activities, or inactivity. For instance, a customer who inputs their PIN incorrectly three times while trying to make a payment online may find their card temporarily blocked. To resolve this, businesses can provide clear instructions for alternative payment methods and encourage customers to contact their bank to unblock their cards.

By understanding and addressing these common reasons for credit card payment failures, businesses can reduce the likelihood of missed payments, improve customer experience, and safeguard their revenue.

How to Fix These Failures

- Implement Smart Retry Logic

- Use automated systems to retry failed payments based on error codes and optimal timing.

- Spread retries over a few days to increase the likelihood of success.

- Send Expiry Notifications

- Proactively notify customers about upcoming card expiration and prompt them to update their details.

- Offer Multiple Payment Options

- Provide alternatives like PayPal, bank transfers, or digital wallets to reduce reliance on credit cards.

- Address Fraud Concerns

- Work with payment processors to ensure legitimate transactions aren’t flagged unnecessarily.

- Communicate with Customers

- Use email or SMS to inform customers about payment issues and guide them on resolving them.

- Optimize Payment Processes

- Regularly test your payment gateway to ensure smooth transactions.

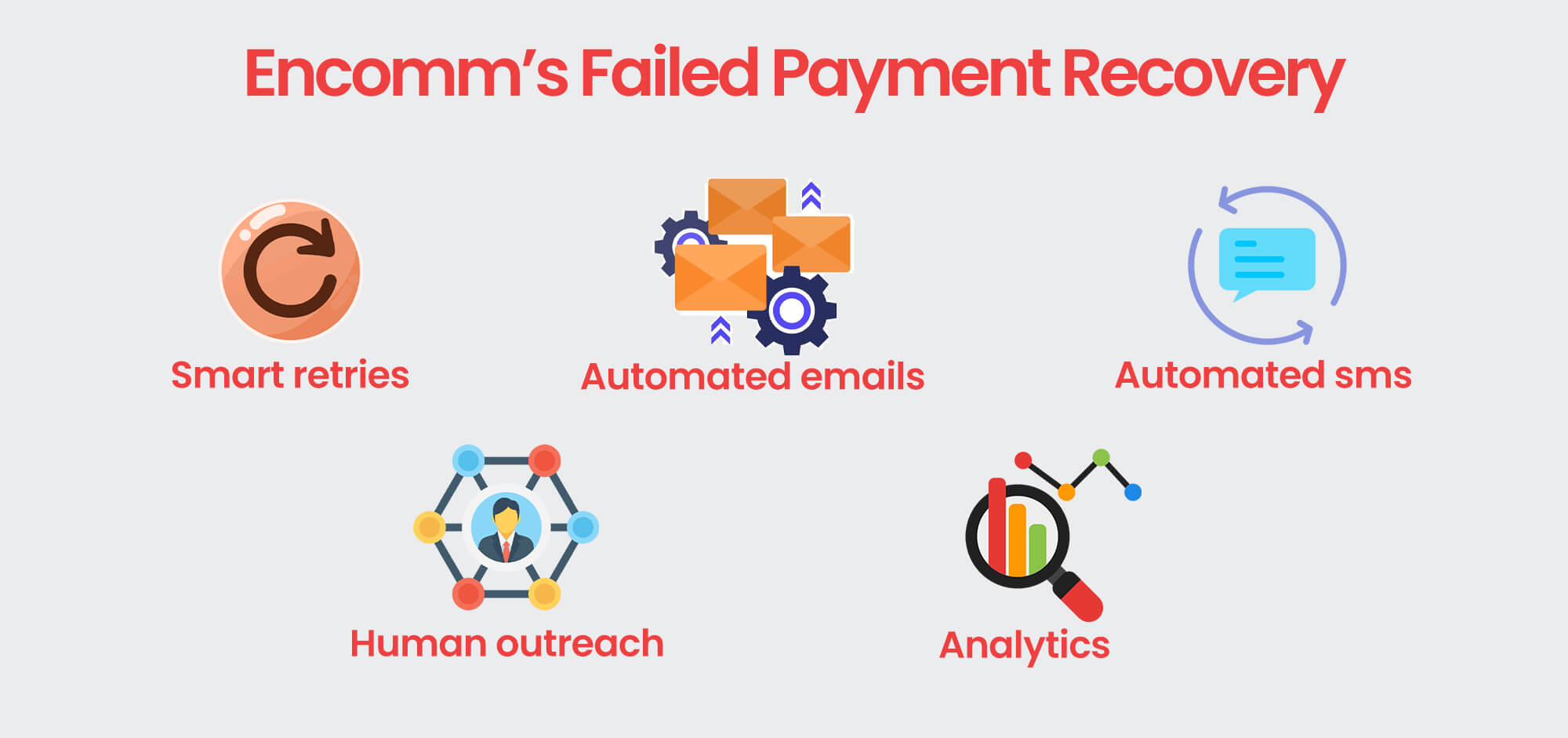

How enComm’s Failed Payment Recovery Solution Can Help

Failed payments can significantly impact a business’s revenue and customer retention. EnComm offers a comprehensive recovery solution to tackle these challenges effectively, combining automation, personalized outreach, and actionable analytics to minimize involuntary churn. Here’s a detailed look at how enComm’s solution helps businesses recover failed payments:

Smart Retries

EnComm’s subscriptions app employs an intelligent retry system to maximize the chances of recovering failed payments. For instance, if a transaction fails due to a network issue, the system schedules a retry after a specific interval of time. By optimizing the timing and logic of retries, businesses can significantly increase the success rate of recovering payments.

Automated Workflows

Communication is key when a payment fails, and enComm’s automated workflows ensure timely and efficient outreach to customers. The system sends well-crafted email and SMS notifications to inform customers about the payment failure, including clear instructions and secure links to update their payment details. For example, a subscription box customer whose payment fails due to an expired card will receive a prompt notification guiding them to update their card information with just a few clicks. This seamless process not only recovers revenue but also enhances the customer experience by eliminating frustration and delays.

Proactive Human Outreach

While automation is powerful, there are instances where a personal touch is needed to resolve payment issues effectively. EnComm provides dedicated call center agents who reach out to customers directly to address unresolved payment failures. For example, if a transaction is declined due to suspected fraud or a blocked card, a call center agent can guide the customer through the necessary steps to resolve the issue with their bank. This human interaction not only improves recovery rates but also fosters stronger customer relationships and loyalty.

Analytics and Insights

Understanding why payments fail and how to recover them is critical for businesses to refine their dunning strategies. EnComm’s platform offers in-depth analytics and insights into payment failures, providing businesses with detailed data on failure rates, reasons for declines, and recovery success. For instance, businesses can identify patterns such as a high volume of failures due to expired cards and implement proactive measures like pre-billing reminders. These insights allow businesses to continuously optimize their recovery processes and minimize future churn.

EnComm’s failed payment recovery solution ensures businesses can recover lost revenue while maintaining customer satisfaction. By combining intelligent retries, automated workflows, human outreach, and actionable analytics, enComm helps businesses address payment failures holistically. Whether it’s retaining a loyal customer whose payment was declined due to insufficient funds or recovering revenue from a lapsed subscription, enComm enables businesses to deliver seamless and uninterrupted experiences, ultimately driving long-term growth and profitability.

Closing Statements

Failed subscription payments don’t have to result in lost customers or revenue. By understanding the causes of payment failures and leveraging a robust recovery strategy, businesses can significantly reduce involuntary churn.

With solutions like enComm, you can transform payment failures into opportunities to strengthen customer relationships and boost revenue. Ready to take control of your subscription payments? Contact us today to learn how we can help.